Valuation

Problem: company A's shares trade at 5€ apiece. Is it good or bad price? Should you buy or sell?

Intro

We've witnessed quite often that people don't understand where the price of certain instrument comes from or whether something is over- or undervalued. Some simply prefer 1€ stock to 5€ stock because - of course - it's cheaper. Some look at the Funderbeam1 price corridor and think that buying in from the low end means good price. Some think that if a price has doubled, it's time to sell half.

We'll suggest an arguably more systematic approach - one that compares market value with company financials.

Please be aware that it really is an introduction - a rule of thumb for quick estimates, a first signal to be evaluated in the context of market sentiment and your portfolio composition and your financial capabilities.

This does not substitute proper understanding of risks involved - you could still lose all your investments. Nor is it a portfolio management theory as it doesn’t account for any other instruments you might be exposed to.

And if, after reading this, you want to argue that we should look at CAC and ROCE and all the other interesting parameters, then this text is not for you - you're advanced enough to know your ways.

But let’s get to the point and calculate the market value.

Market Value

Market value has many synonyms: market capitalization, market cap, mcap is convenient in Twitter.

Market value is determined from traded shares and calculated with very simple formula:

What you do is take the current share price and multiply it by number of all shares on marketplace and considering only the portion indicated by equity percentage is tradeable, you divide it with equity to get the value of the whole company.

If we take the example of Ampler Bikes share unit:

We arrive at the following numbers2:

This price might or might not have something to do with the actual financials of the company. People can buy shares because somebody else told them it's a good deal driving the price up or sell because they urgently need cash to pay their bills.

Market value might also be influenced by global trends like COVID or stupid memestock status or how Greece’s loans are doing or if Ever Given gets stuck.

It is easy enough to calculate, but it’s not a direct function of what the company is really worth. Instead it’s more of a function of fear and greed of market participants. Most of the time greed wins, but then, just as easily, fear could take over. It’s called price discovery 😀

The lower the liquidity, the more susceptible the price is to sudden unexpected movements. You can look at the market depth view in Funderbeam to determine how many shares you need to buy or sell to considerably affect the price.

Fundamental Value

In case of startups that have revenue, the first and most universal formula to estimate fundamental value is using the multiple of yearly revenue.

That’s all the science there is - you take yearly revenue and multiply it by a number of your choice (usually 5 - no kidding, that’s the go to multiple). In theory the multiplier should depend on how fast the company is growing - so a company growing 30% will get smaller multiplier than a company growing 150%.

If possible, it's best to look at last 12 months revenue - meaning at any time you just sum up the revenue of running last 12 months, because, in startup scene, a lot could change within the months since last year-end.

Let’s use the same Ampler Bikes example:

They publish the last 12 months sales, so if we used not an unreasonable multiple of 5, we’d get:

Which is pretty close to what they’re trading at.

It's not that we think using revenue multiple is very accurate, it's just that in Funderbeam, revenue is pretty much the only thing everybody reports. There're various other numbers reported by different companies, but they're rarely the same, making revenue the only one that can be used to compare companies.

And even here is a catch - is case of platform providers (think of Autolevi and Promoty in Funderbeam, or Bolt in more general context) you have to use Gross Merchandise Value or GMV as this is what best compares to traditional companies' revenue - if you have to make such comparison at all.

It’s best to compare companies that are at least somewhat similar or operate in a similar business or model.

If the company is rather small and the revenue growth is just starting, you might want to look at revenue run rate, which is last month's revenue times 12. But this is already a forward looking number and shouldn’t be directly compared to historical data.

Price/Sales

We can put the two previous calculations together and find a number called P/S3 or Price-to-Sales ratio, which is technically the same revenue multiple, but instead of multiplying revenue by some number, we divide the real market value with revenue:

Using again the Ampler Bikes example:

So we can say that Ampler share units are trading at 5.15 revenue multiple or P/S=5.15.

Let’s think about how the value of this fraction changes and what does it mean.

When the price goes up, the value of the fraction goes up. When price goes down, the value is down.

Now if you're a trader looking for quick profit, you're happy that the price went up and might sell your stock. But when looking at fundamental side of things, the company just got more expensive without anything but market frenzy supporting it.

When sales goes up, but price stays the same, P/S goes down. It means, on relative terms, the company just got cheaper! The company is doing better, but price didn’t rise - you get a better company for the same price.

If you're here for the long game, just rising price is not really something to be happy about. When looking at things in longer perspective, you really really want that sales number to go up. You don't even care about the price going up so much, as long as the sales number skyrockets.

The Model

Next let's establish a corridor:

Anything under P/S=3 is cheap and provided no red flags elsewhere is a BUY.

Anything above P/S=5 is unreasonably expensive, not performing as expected or both, so it’s a signal for SELL.

Anything in between is a HOLD.

NB: We’ve chosen this corridor just because we want to make an example and the actual data fits what we want to say if we choose the P/S corridor in this particular manner. In reality there’re companies on Funderbeam marketplace with P/S ratios from 1,x to 300+, and by no means is P/S>5 too expensive. This is an example.

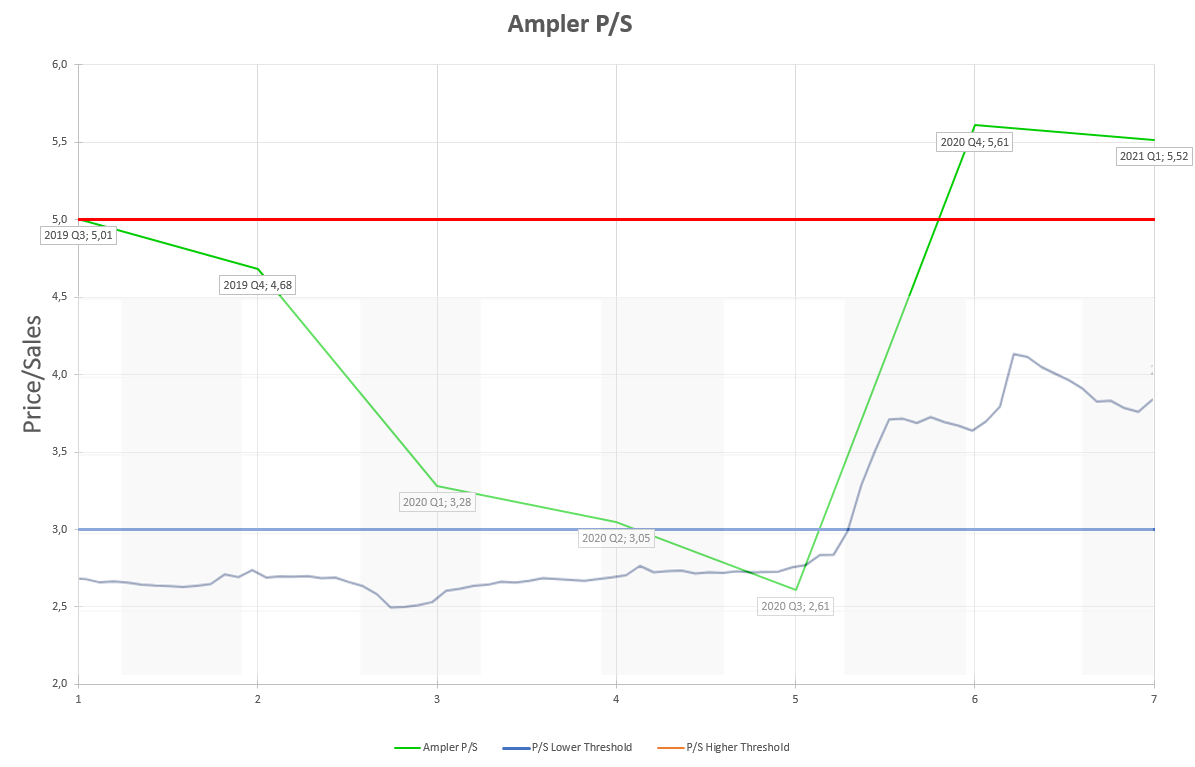

Ampler raised money in 2019 Q3, so assume you took part in that raise.

Q3 report comes in with P/S=5 and in the context of this example, we assume it’s nothing to write home about.

Q4 is low season on bike sales, so it doesn’t change the picture considerably, but puts the P/S safely into the HOLD zone.

Here comes Q1 of 2020 - the price has fallen because of COVID (remember the March dip across all markets?), but now the sales skyrocket, putting P/S in the lower end of the corridor.

Despite price coming back, sales growth continues into Q2 and by Q3, P/S has fallen to 2.6. While the stock price has remained almost on the same level (dark blue line), sales have really taken off. This is a definitive BUY signal.

And market recognizes it as a buy signal - the price more than doubles within a quarter while sales stay the same (Q4 is not a high season for biking either). At high point, P/S reaches 6,3, which is this context is a SELL signal.

But for any practical purposes, we’d probably choose the P/S corridor for Ampler like this:

Are we really just above BUY threshold you might ask?

Well, let’s take the next heavyweight hardware producer in Funderbeam and apply the same 5-10 corridor:

Update 07.09.2021: We wanted to update the above chart, but can no longer show the price movement together with P/S because 1) Funderbeam changed the way they display charts and 2) HUUM split their instrument. So here’s the updated chart without price overlay:

HUUM has definitely done well, crushed the targets, then upped the targets by 60% and then crushed it again by 100%. It’s incredible run, no arguing. But the price has been on the run too - and even more so if we follow the P/S ratio.

But as we said before - a company that is growing faster can get a higher multiplier. In this case HUUM expects to grow 200% while Ampler expects more like a flat year (they’ve consistently grown 100% a year, but this year they’re struggling with components availability due to COVID disrupting supply chains).

We leave for readers to decide whether HUUM growth justifies almost double P/S. Or even better - choose your own corridor, populate it with data, compare companies, think where you’d have made or lost money. The purpose here is to give you a fishing rod, not fish.

For example - Bikeep is a somewhat similar company that’s going to raise new round soon, so it’s a good candidate for comparison.

Conclusions

Market value is well defined, but it might not be so well connected to reality.

Fundamental value is harder to figure out, but hopefully a better representative of company’s financial status and possible success.

We look for places where market value and our fundamental estimates are moving out of sync for buy/hold/sell signals.

P/S is by no means the holy grail of startup valuation, but it provides a framework for more systematic approach. Factor in growth and you might be on to something.

The bottom line is - run your numbers, compare comparable companies and certainly look at broader picture, not just revenue.

Oh, did we say it’s not investment advice?

Request for Readers

Please like and subscribe! Haha.

But seriously, putting together these datasets are time-consuming and error-prone manual labor. But it doesn’t have to be.

Funderbeam could start asking the trailing 12 months revenue number from companies with every update and put together an ‘analytics screen’ we’ve described here:

Quite frankly, we just hate surfing those PDFs which contain random stuff the company thinks is important, but the relevant numbers are almost always hidden somewhere, with a catch, without a comparison period, brought out as percentages of something - without giving us that something, etc, just not what is needed.

So one way is to start pleading every company to report 12m revenue or ask Funderbeam to make it mandatory. It doesn’t directly help Funderbeam business, but it makes Funderbeam a better place for investor.

Disclosure

Nugis Aino holds both Ampler Bikes and HUUM instruments in considerable amount relative to the portfolio.

To be completely honest, Nugis lately sold Ampler and bought HUUM, despite the above analysis suggesting the opposite. But it was more of a risk management move than investment decision.

We hope to cover portfolio and risk management in the future.

Notes

Data used for Ampler chart:

Data used for HUUM chart:

The price is picked from the time the relevant report was published. We didn’t cherry pick it in any direction, it was first price on the chart after the report. The chart is not daily.

This text will contain examples from equity crowdfunding platform Funderbeam, but the general concepts are applicable across the board.

It’s a bit unclear why Funderbeam sometimes arrives at slightly different numbers - whether this is a rounding issue, something in the cap table that we don’t know about or a multiplier which is known to be used in case of Funderbeam 1 and 2 syndicates. They don’t publish the calculation basis, but it’s sometimes impossible to get exactly the same number using public data only.

One theory is that Funderbeam doesn’t round prices to 2 decimal points internally and when dealing with tens or hundreds of millions, these fractions play a role. For example, when calculating Change mcap these two prices: 11 and 10.995 result in 110K difference in mcap.

This is not the same as P/E or Price/Earnings used by big public companies.

Hea teemapüstitus, startupperid tihti ei tea börsi loogikat, börsi taustaga investorid jälle mis startupi hinda mõjutab, järelturgu jälgitakse väga vähe ja järelturust võiks investorid rohkem aru saada. Norm katse.

Iseküss kas viimase 12 kuu käive palju näitab, nt mõnel suurema kasvukiirusega ettevõttel on viimase 12 kuu käive väiksem kui aeglasema kasvuga omal, aga suurem kasvukiirus on selgelt oluliselt parem. Pigem (net) Revenue run rate, aga eks seal ka hooajaliste puhul küsimusi ja kui on mõni loogiliselt seletatav ettevõtte väline ajutine nõrkus, kas peaks ühe kvartali keskpärane tulemus kohe valuatsiooni mitukümmend % alla viima? Eriti kui väljavaade hoopis paranes ja kehvemad konkurendid suuremates raskustes on nagu juhtus Boltil ja on juhtumas Ampleriga? Ning ka revenu run rate oleks ikkagi päris pealiskaudne võrdus, tiim, turu suurus, ajastus, kuluefektiivne kiire toorearendus, kliendi fookus. Pigem peaks ka võrdlema järgmise või ülejärgmise aasta käibega.

Nt Ampleril oleks enne ilma kaasamiseta järgm aasta teinud €35-50m käivet, nüüd kaasamisega ikkagi realistlik ehk suurusjärgus 1,3-2x järgmise aasta käivet, pigem alla ülejärgmise aasta käibe kauplemas, mis on suht ennekuulmatu nii tugeva tiimi kohta avalikult kaubeldaval turul. USA börsil võrreldakse kasvuettevõtteid ikkagi mingisuguse järgneva aasta käibe baasil, nt siin Andreessen Horowitzi väga hea lihtne lugemine teemal: https://a16z.com/2020/08/17/role-of-entry-multiples-in-valuations/ Vbla Saunum suudabki mõnele üksikule välismaa early adopterile müüa, rohkem hetkel verifitseeritud pole ja äkki koroona lõppemisega saunabuum läbi, turg ja ettevõtted jätkavad 5-10% kasvu? vs Ampler mis müüb konservatiivse Saksa turu 40+ vanuses late majority kliendile +20% kasvava turu tingimustes ikkagi aastas üle 120% kasvu maha nagu eelmine aasta.

Nii palju näitajaid on veel, mis mõjutavad rohkemgi kui face valu numbreid ragistada. Nt Stebby oma +€120k netokäibe ja €600k GMV'ga on umbes sama "kallis" kui pre-revenue Forpeeps (täielik müstika, miks neile üldse raha anti). Nt siin Calacanis kirjutas USA valuatsioonidest: https://calacanis.com/2021/05/31/on-2021-startup-valuations/

Siin veel väga häid raamatuid, mis aitavad startupmaailmat erinevate nurkade alt paremini mõista ja ka ettevõtteid siis hinnastada, lisaks Calacanise Angelile:

https://www.amazon.com/Hacking-Growth-Fastest-Growing-Companies-Breakout/dp/045149721X

https://www.amazon.com/Blitzscaling-Lightning-Fast-Building-Massively-Companies/dp/1524761419

https://www.amazon.com/Customer-Success-Innovative-Companies-Recurring/dp/1119167965

https://www.amazon.com/Crossing-Chasm-3rd-Disruptive-Mainstream/dp/0062292986/